Lesson 3. Types of Binary Options

While Binary options traditionally started out with the plain CALL/PUT options over time the different binary options contracts have evolved giving rise to different type of Binary options. The wide choice offered caters to different types of trader profiles and risk sentiment. Understanding the different types of binary options is essential for a trader before they blindly start trading one of the many types of options that are available. In this article, we explain the different kinds of option expiries in an effort to educate the reader about the same.

In this lesson, we will address the following topics:

- High/Low Binary Options

- Touch Binary Options

- No Touch options

- Which options are the best to start with?

1. High/Low Binary Options

The traditional CALL/PUT option, trading High Low option is as simple as speculating if the price of an instrument will close above the price at which the contract was entered or if the price will close lower than the strike price. CALL/PUT options are one of the easiest of binary options to trade. They typically offer a return of 60 – 75% of the invested amount and there is a wide choice of expiry date and times to choose from.

2. Touch Binary Options

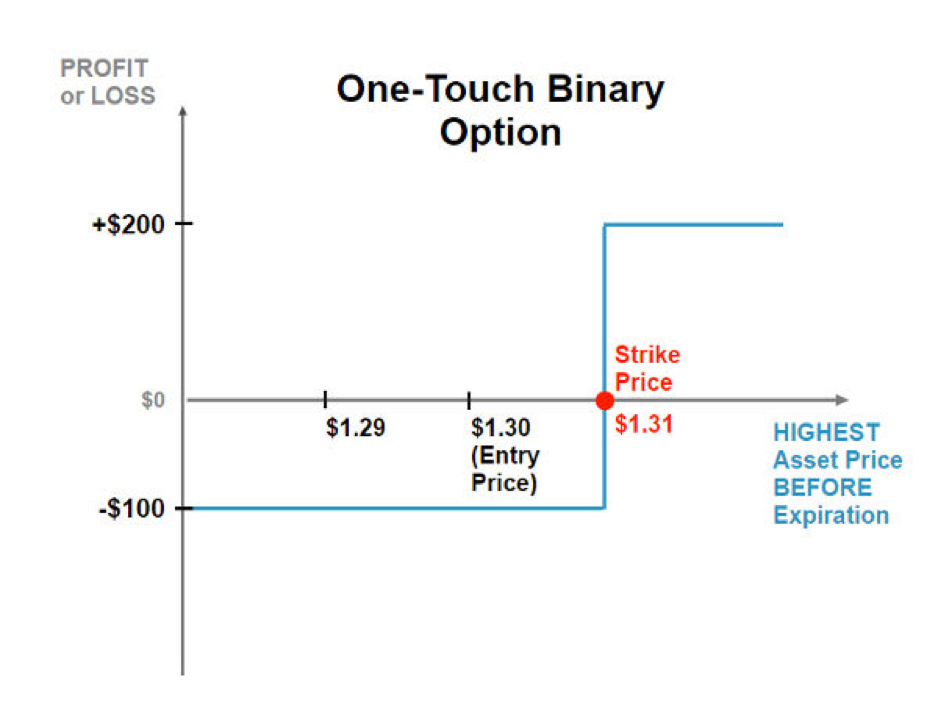

“One Touch” options close when the price reaches a target level before the end of the expiration period. If the price reaches the target level, the deal is closed and the trader will have made a profit.

The idea of the “One Touch” option:

- The trader forecasts the movement of a price (let’s say “down” for the sake of example) and opens a trade.

- The level will then be displayed under the price, indicating the level the price should “touch” before the transaction is completed. The “touch” level is established when the trade is set as well as the projected earnings.

- If the price hits the required mark before the end of the expiration period, then the contract will close ahead of schedule and the trader will receive their profit.

- If the price does not reach the required level in the specified time period, the trader will lose the entire invested amount.

3. No Touch Option

The “No Touch” option is the opposite of the “One Touch” option, through which you can bet that an asset price will NOT reach a specific value over a specific period of time.

The essence of the “No Touch” binary option:

- The trader tries to predict the movement of the asset price so that it does NOT touch the option level (for example, “Up”) and creates a trade.

- After the contract is established, a predetermined level appears below the price to indicate the level that should not be reached over a defined period of time.

- If the specified price level is reached before the deal expires, the contract will be immediately closed and the trader will lose their invested funds.

- If the price does not touch the specified level before the deal expires, then the forecast will be successful and the trader will earn the profit designated when the trade was established.

4. Which options are the best to start with?

As you can see, there are a huge number of binary option types. Every option has its pros and cons, but what are the best ones for beginners?

If you are just starting out or trading for the first time, we recommend that you stick with classic options. They are easy to learn and generally less risky than other types of options. Practice trading with classic options to improve your skills and switch to more complex types of binary options in the future.